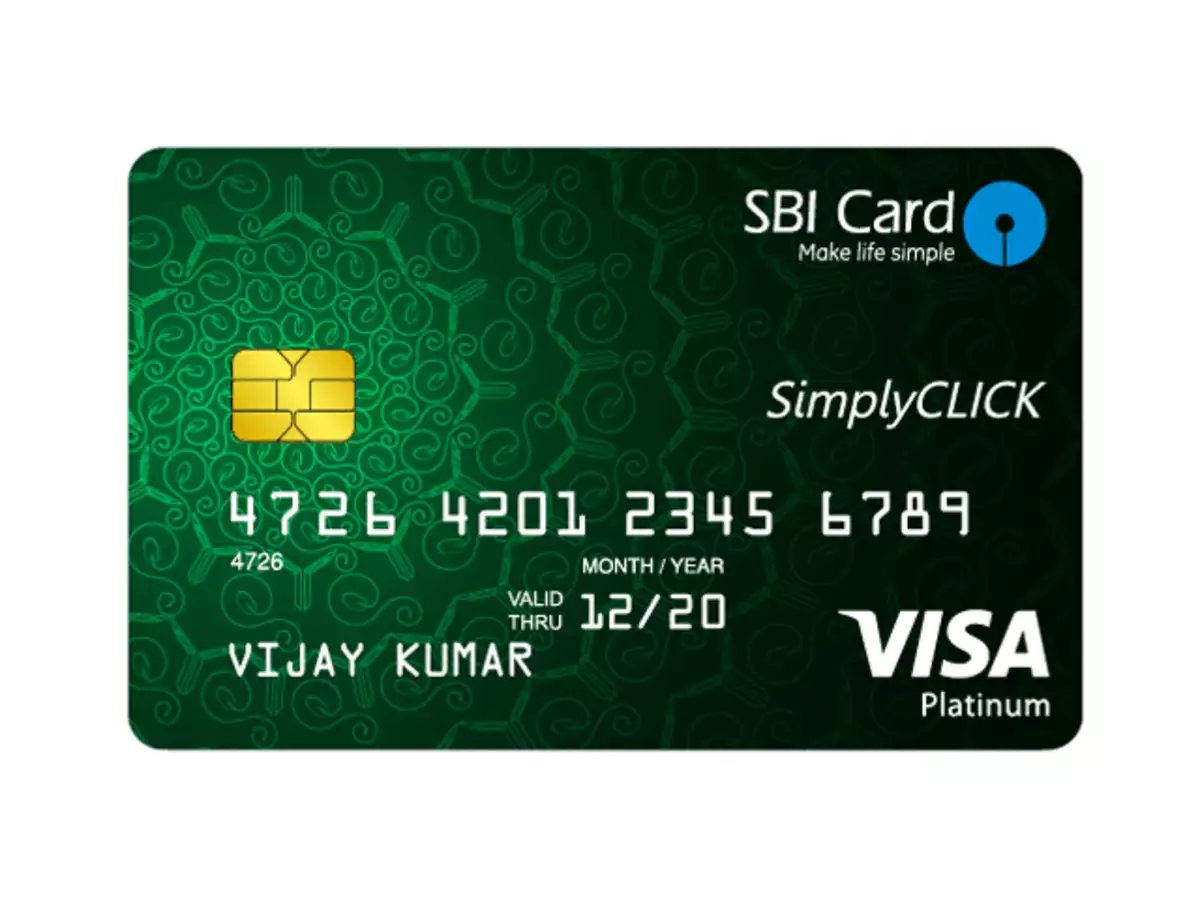

SBI Simply Click Credit Card Review & Benefits

SBI Simply Click is a popular credit card offered by the State Bank of India (SBI), designed for online shoppers. This card provides a range of benefits and rewards for online shopping, including cashback and discounts on various online platforms. If you are an avid online shopper, here is what you need to know about the SBI Simply Click Credit Card.

Apply here- Click here

Rewards and Benefits: The SBI Simply Click credit card offers a range of rewards and benefits for online shopping, including 10x rewards points on online spending on select partner websites, such as Amazon, Flipkart, and BookMyShow. Additionally, cardholders can enjoy discounts and cashback offers on a variety of online platforms, such as food delivery, travel booking, and more.

Eligibility and Documentation: To be eligible for the SBI Simply Click credit card, you must be an Indian resident and have a minimum income of Rs. 1,50,000 per annum. You will also need to provide certain documents, such as proof of identity, proof of address, and proof of income when applying for the card.

Apply here- Click here

Fees and Charges: The SBI Simply Click credit card has an annual fee of Rs. 499, which is waived for the first year. Other fees and charges include a late payment fee of up to Rs. 100, a cash advance fee of 2.5% of the transaction amount, and an over-limit fee of Rs. 500. It is important to understand all the fees and charges associated with the card before applying, to avoid any surprises down the line.

Security Features: SBI Simply Click credit card comes with several security features to protect you from fraud and unauthorized transactions. The card is equipped with a chip and pin system, which provides an extra layer of security when making transactions. Additionally, the bank provides SMS alerts for every transaction made with the card, allowing you to monitor your spending and detect any unauthorized transactions quickly.

Customer Service: SBI offers excellent customer service for its credit cardholders, with a dedicated 24/7 customer care hotline available for assistance. In case of lost or stolen cards, you can report them to the bank immediately and request for a replacement card.

Apply here- Click here

Repayment and Credit Limit: The SBI Simply Click credit card has a flexible repayment option, allowing cardholders to choose the due date for their payments. The bank will also assign a credit limit to each cardholder, based on their income and credit history. It is important to stay within your credit limit and make timely payments to avoid late fees and interest charges, and to maintain a good credit score.

In conclusion, the SBI Simply Click credit card is a great option for online shoppers looking for rewards, discounts, and cashback offers. However, it is important to understand the fees, charges, and terms and conditions associated with the card, and to use it responsibly to avoid any financial problems. If you are an online shopper, this card is worth considering as it provides excellent benefits and rewards for your online purchases.

Related post-